NEWS

What Happened This Week

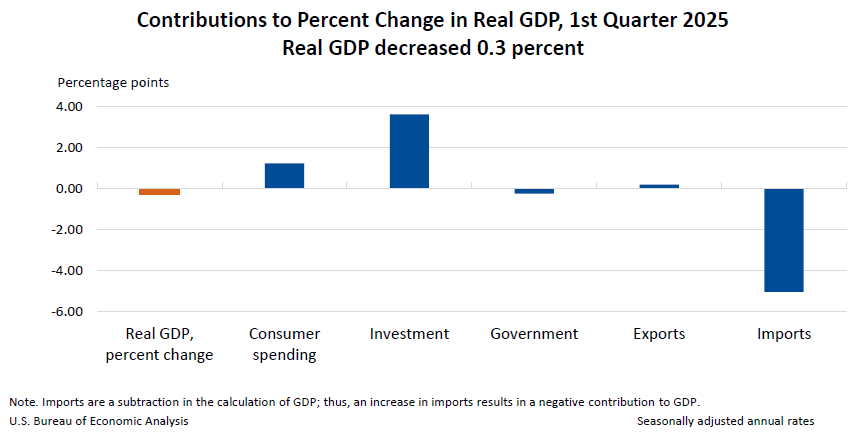

- US Real GDP declined by -0.3% in the first quarter of 2025.

- This decrease was largely caused by an increase in imports (which is a negative in the GDP equation) and decrease in government spending.

- There were increases in exports, investment and consumer spending.

- The Personal Consumption Index (PCE) increased an annualized 3.6% in Q1, an acceleration in inflation since last quarter’s 2.4%.

- The US Manufacturing PMI improved to 50.7 in April, well above expectations.

- The US Services PMI dropped below expectations, however, to 51.4.

- PMI numbers above 50 suggest a growing economy, but business confidence and output sentiment dropped due to continued uncertainty.

How I See It

Last week, I mentioned that we’d likely hit resistance around $5,689 for the S&P 500.

This week, the S&P 500 had a great week, touched $5,700, but closed just below at $5,686.67, meeting that slight resistance I forecasted.

It’s become clear that the US government is likely to continue making changes that keep uncertainty high. The good news is that investment improved last quarter, and the dramatic increase in imports is not likely to repeat itself in the second quarter.

The Fed is in a difficult place, because if they keep interest rates steady, this could push markets lower which may be more difficult this time to recover from. If they lower interest rates, they risk adding fuel to an already accelerated inflation rate.

Which one is most important in order to avoid recession?

In my opinion, two things need to happen.

- I think the Fed needs to focus on unemployment more than inflation right now, which means lowering the interest rate by 25 bps (0.25%) in May.

- I think the Federal government needs to make quick work of their economic plan, announcing the specifics of any planned tax cuts, along with any other major sweeping changes. Get it all out now so that uncertainty can only decrease from this point.

We’ll know if point 1 happens next week.

The good news right now is that, despite sentiment falling, there still remains potential for continued growth, even renewed strength, if the government and the Fed can remove some uncertainty and instill clearer direction with immediate action.