The US National Debt stands at $37.5 trillion, rising currently at a deficit of nearly $2 trillion in the year ahead.

Is it possible the U.S. government is close to defaulting on its debt, sending the economy into a downward spiral?

Are we facing a US national debt crisis?

Possible? Anything is possible.

Probable? No, in my opinion.

But the financial picture is more strained than it has been in decades—and it could make the year ahead a bumpy ride.

What is the Federal Reserve Up To?

The Federal Reserve finally cut interest rates by 0.25% on Wednesday the 17th.

After hiking aggressively through 2022–2023—which sparked a bear market (stocks down 20%+) but not a recession—the Fed paused in late 2024 to see how inflation would respond. The goal of this cut? Keep jobs strong without reigniting inflation.

Here’s the twist: Only twice out of ten times in the last 60 years have rates inverted like this without triggering a recession. Inversion is when short-term rates are higher than long-term rates.

Are we just seeing a delayed reaction? Could a downturn be around the corner?

Historically, in five of eight recessions since 1965, the Fed cut rates before the recession officially hit. Yet this most recent yield curve inversion—the longest and third-deepest in six decades—hasn’t slowed growth or the job market.

Why?

Two words: government spending.

The fiscal deficit—spending beyond revenue—soared during COVID and hasn’t returned to pre-pandemic levels. Normally, deficits spike during crises and then shrink as the economy stabilizes. That’s the way the Keynesian economic theory is supposed to work.

But not this time.

The US debt problem continues to grow even in economic expansion.

We’re still waiting to see any real cuts in government spending.

How Long Can the U.S. Sustain This Debt?

When considering whether we are facing a US national debt crisis, a key question naturally arises: how long can the government sustain this pace of borrowing?

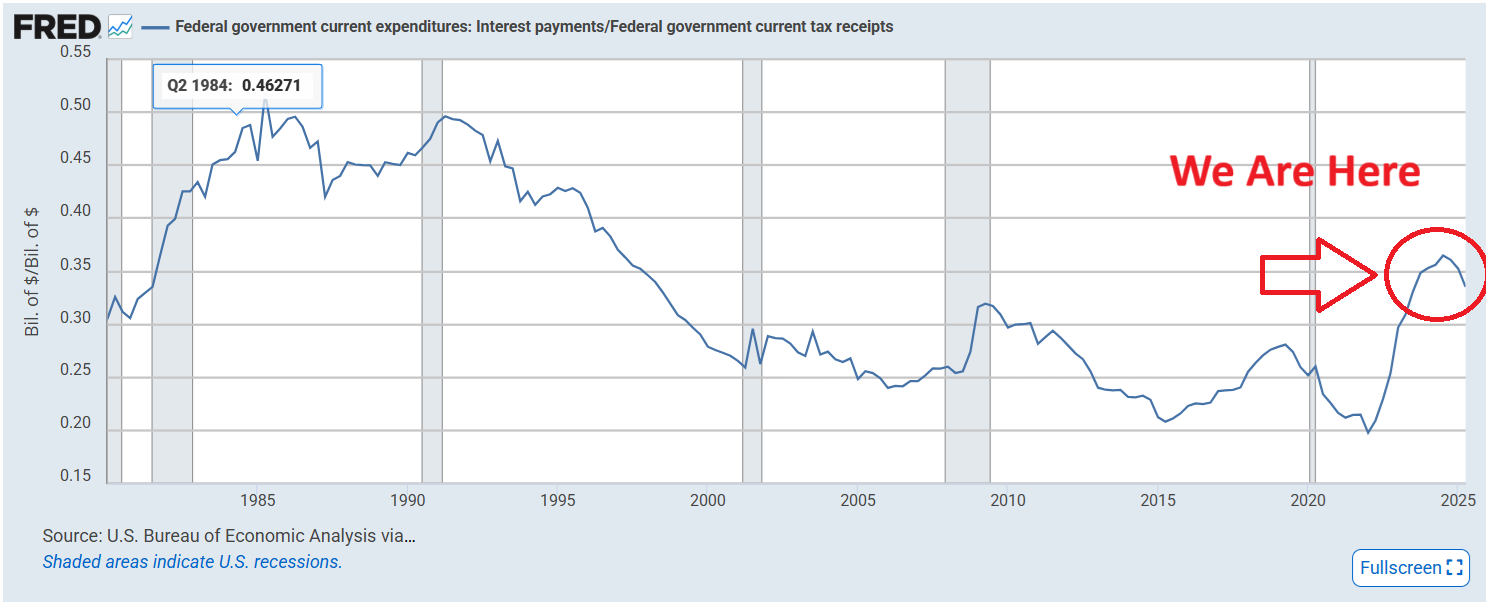

This year, government tax receipts can cover interest payments by about 3x over.

Compare this to 2022, before rate hikes: coverage was about 5x. Even during the Great Recession, it was slightly better, around 3.1x. The problem isn’t just higher interest—it’s that new debt keeps piling up faster than ever.

Let’s put it in household terms:

-

Imagine earning $100,000/year with $800,000 in debt.

-

Monthly interest alone: nearly $2,800 (not counting principal).

-

Debt grows by $40,000/year, while income rises just $5,000/year.

-

At 4.75% interest, that $40,000 adds about $1,900/year in new interest.

After covering new interest, the household has $3,100 left of the additional income—some of which still goes to principal.

This isn’t a perfect allegory, but it makes the situation a bit more comprehensible.

Unlike a household, the government can roll over maturing debt by issuing new bonds, effectively funding old debt with new debt, as long as revenue grows. This structure keeps the US government debt sustainable, at least for now. But it increases long-term vulnerability if growth slows.

Think of it as having an endless credit card, but without the late fees!

Bottom line: Interest takes a bigger bite of revenue than before, and borrowing still outpaces income growth. The financial picture is strained—but technically sustainable.

The Job Market Adds a Wrinkle

Job growth in July and August looks healthy, but much of it comes from sectors heavily influenced by government spending: leisure and hospitality, private education and health services, and government itself. And this holds true even as the US debt problem puts pressure on federal spending priorities.

Outside these, job growth has been on the decline for months. The economy can sustain this—but it’s a delicate, wobbly balance.

One misstep from policymakers or the Fed could tip it the wrong way.

What This Means for You

Talk of the US going bankrupt in the foreseeable future is overblown. We’ve survived bigger storms.

Catastrophic collapse? Unlikely.

But historically high debt compared to earnings sets the stage for a volatile market.

My read: likelihood is elevated for the next 12 months to see a correction (down 10–20%) or even a bear market (down 20% or more). Upside potential still outweighs downside, but risk management is crucial.

Risks to keep in mind:

-

Growing deficits could increase taxation or (more likely) inflation.

-

Stocks are already expensive; small shifts in outlook can have outsized effects.

-

Balancing slowing inflation with low unemployment is tricky—stagflation remains possible, though likely moderate.

-

The economy leans heavily on government spending.

-

The Fed historically struggles to engineer “soft landings.”

Strategy tip: Timing the market is a losing game. Instead:

-

Review your risk tolerance.

-

Decide how much downside you can ride through.

-

Consider adjusting your allocation to reduce the chance of heavy losses.

-

Remember:

-

Stocks = more short-term risk

-

Bonds = less short-term risk

-

The goal isn’t to get out at the top or dodge every dip—it’s to avoid the worst of the downside while staying invested.

Managing risk during periods of high government debt, especially amid the alleged US debt crisis, starts with clarity and long-term planning.

When You’re Ready

In the upcoming Wealth Expedition membership, you’ll get:

-

A watchlist of funds (informational only, not personal recommendations)

-

My personal assessment of where the stock market is headed

-

Strategies based on hypothetical case studies reflecting today’s events

-

Access to forums for guidance on investing, budgeting, debt reduction, income growth, and entrepreneurship

-

A step-by-step map that provides the knowledge, the inspiration and the practical actions to accelerate your financial journey from zero to comprehensive abundance

If you want to be a Founding Member and secure lifetime perks, sign up now—platform launch is imminent, and I can’t wait to share it with you!

For Further Reading, Check Out:

What 15 Bear Markets Teach Us About Today’s Risks

The Future of Social Security — Can We Count On It?

Does Bitcoin Belong in Your Investment Portfolio?

Psychology of Investing: Why Fear Costs More Than Failure Ever Could