FINANCIAL TOOL

Investor Sentiment

Dropping fast! That’s a market headline no one enjoys waking up to.

There’s no question that markets have been shaky over the past several weeks, and that often causes investors to pause and consider if now’s the time to jump out.

While there’s no unfailing hard-and-fast rule, there are several interconnecting indicators we can watch for signs.

The first is the speed of the drop.

The reason for market declines can be categorized into two broad reasons: sentiment and fundamentals.

Sentiment causes markets to drop fast and violently, because it’s driven by very short-term thinking. Now, some of these investors might have good reason to jump out. Maybe they’re very short-term focused. But most of the time, it’s just long-term investors making poor, knee-jerk reactions.

Fundamentals often cause markets to round off at the top, making slow and gradual declines over a few months as they try but fail to continue higher.

Sentiment is short-term. It usually reverses about as quickly as it starts. Psychology outruns fundamentals and often exaggerates due to the effects of Prospect Theory.

Fundamentals are often longer term. They are actual changes in economic realities that dramatically impact future earning potential.

For a recession to occur, which often is preceded by the start of a bear market, the magnitude of economic impact often needs to amount to trillions of dollars across the globe.

And here’s the other thing: the longer a recession is anticipated, the less likely it is to occur. Why? Because businesses and consumers have time to adjust and prepare.

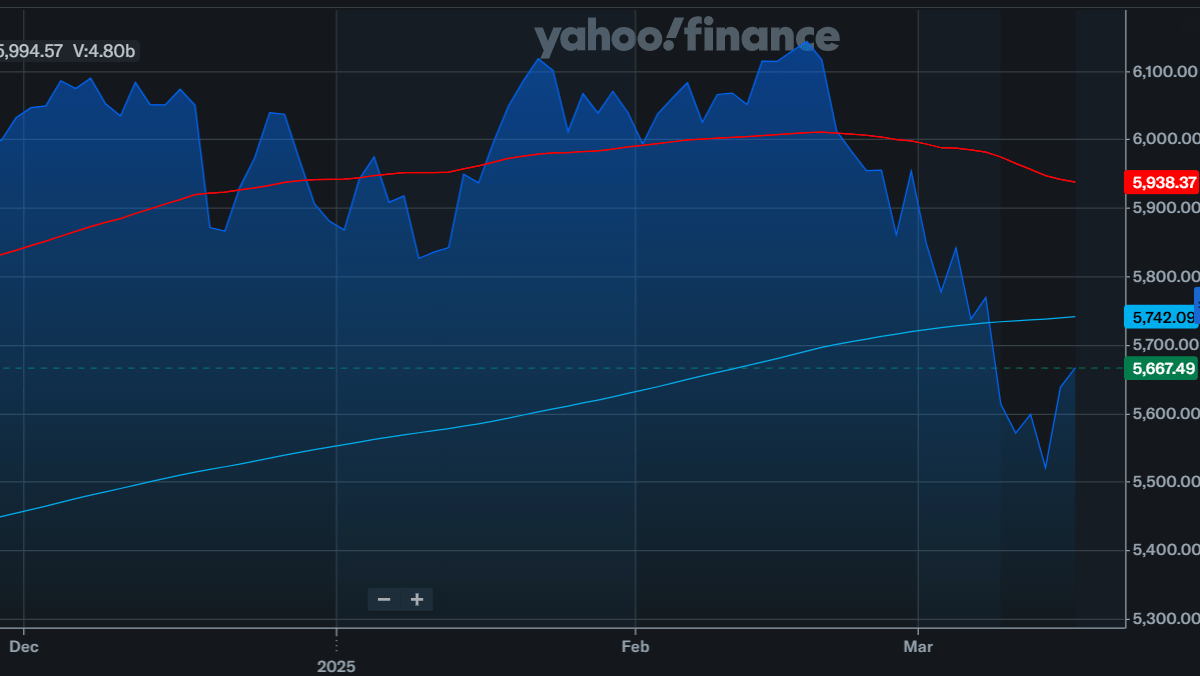

Is recent volatility the start of a bear market? It’s still too soon to tell. But early signs show a steep drop of about 10% in a month’s time. That’s faster than a typical bear market begins but very much on par for a normal correction.

Is more volatility likely in the days ahead? Yes. The price of the S&P 500 is below its 50- and 200-day moving averages.

Source: Yahoo Finance

But here’s the good news.

Believe it or not, this volatility is not uncommon for the first year of a President’s term, especially a Republican President. Not because of bad decisions, per se. But simply for these reasons:

- Enthusiasm for a business-friendly environment often inflates around the election date.

- Immediate optimism tends to become more grounded in the inauguration year.

- The Congress and the President often have stronger potential to make things happen before the mid-term elections, which creates temporary uncertainty and caution among investors and businesses.

None of these things are bad in and of themselves. Change, whether good or bad, is often reacted to with uncertainty and strong opinions. And the feeling of loss is felt more acutely than the equivalent feeling of gain.

It’s just the way the market perceives and deals with risk.

Those with long-term investment goals (think 5+ years) are often better to ride out volatility than to attempt to time the market and be wrong. Locking in losses just before a fast upward rally can be very costly, especially when considering the opportunity cost of lost compounded returns.

As I predicted a 2025 correction back on December 9, I will continue to monitor the market conditions for more telling signs of any developing bear market.