Disclaimer: This newsletter is for educational purposes only and is not personalized financial or investment advice. Consult a qualified professional before making financial decisions.

️ I’ve also covered this topic in a short YouTube video—check it out here.

FINANCIAL TOOL

4 Investment Strategies for Late-Stage Bull Markets

In this article, we’ll explore several investment strategies for late-stage bull markets: approaches designed to help investors manage risk while staying positioned for opportunity.

Here’s my opinion: the stock market is currently priced for perfection (as of this article’s publication).

That is, valuations are so high that investors are betting on several more years of strong earnings growth simply to justify current prices.

Prices are increasingly less connected with what’s happening right now, and more dependent on future realities going very well.

Understanding market cycle investing helps clarify where we stand today and what strategies may make sense next. If we’re in a late-stage bull market, then strategic investing requires balancing optimism with discipline.

Since a stock’s hypothetical intrinsic value is based on the present value of future earnings, even modest shifts in expectations can ripple sharply through current prices.

Here’s my view.

Strong upside (20%+) over the next year would be akin to a euphoric bubble.

Moderate upside (1% – 15%) would be healthy growth.

But a bear market (-20% or more to the downside) has grown in likelihood due to a number of factors:

-

The after-effects of aggressive rate hiking by the Fed

-

The high speculation in private markets

-

The upcoming second year of a US President’s term (historically the lowest average performing year)

-

The off-balanced risk/reward ratio over the next several years at current high valuations

Think about it this way. Let’s assign arbitrary likelihoods to risk and reward to illustrate the point.

If someone has a 50% chance of a 15% gain, a 25% chance of no return, and a 25% chance of a 20% loss, the expected gain is only about 2.5%.

But 2.5% expected return is far too low to justify the risk of the whole stock market. We could probably expect more just sitting in a CD!

Still, markets can defy gravity for long stretches. Late-cycle rallies often deliver impressive final gains.

At moments like this, adopting a partially defensive investment strategy can help protect long-term goals without abandoning growth entirely.

Going all conservative, and being wrong about it, presents a huge risk to your ability to reach your future goals if those goals depend on market-like returns over time.

So if no one can predict when the next big downturn arrives, the question becomes: how do you structure a portfolio that can endure either outcome?”

Here’s something to consider.

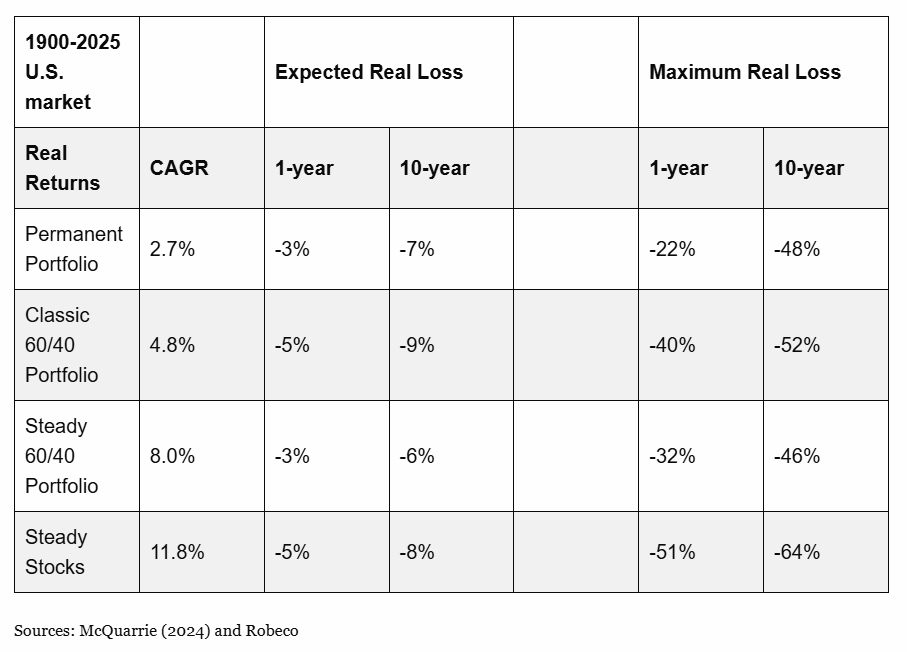

Pim van Vliet, PhD, Chief Quant Strategist at Robeco, explored this idea in his recent article. His research covering 1900 to 2025 shows that every asset—cash, bonds, gold, and stocks—has suffered painful real (inflation-adjusted) losses at times.

Cash erodes quietly.

Bonds face “bond winters” when inflation rises.

Gold swings wildly.

And stocks, though rewarding long-term, endure deep drawdowns.

So how do we solve this equation of risk and reward?

A time-tested portfolio strategy for bull markets can help smooth volatility while maintaining exposure to long-term growth.

Here are four low- to moderate-volatility portfolio types to compare.

-

The Permanent Portfolio is an equal blend of 25% four ways: stocks, bonds, savings and gold.

-

The Classic 60/40 Portfolio is a blend of 60% stocks and 40% bonds.

-

Steady Stocks are Vliet’s term for stocks with low standard deviation (low volatility), high dividends and positive momentum.

-

Steady 60/40 Portfolio takes the Classic 60/40 Portfolio and substitutes the 60% stocks with specifically low volatility stocks (per his definition).

In van Vliet’s century-plus back-test, the Permanent Portfolio had the smallest short-term losses, but over ten-year periods the Steady 60/40 approach delivered nearly as much downside protection with far higher long-term growth.

His research highlights how low-volatility investing can deliver similar returns to traditional portfolios, but with a smoother ride.

The lesson: blending low-volatility, income-producing equities with bonds can smooth the ride without giving up much return over 10 years or less.

For investors seeking greater stability, a moderate investment portfolio can offer a steadier ride without abandoning long-term growth.

While past performance is no guarantee of future returns, this extensive back-test can offer a picture of how different asset classes, and stock types, can work together as part of a whole strategy for attaining financial goals.

Each of these investment strategies for late-stage bull markets approaches risk and return trade-offs differently, offering investors options based on their own comfort level.

Sound investment risk management ensures that even during volatile markets, your portfolio remains aligned with long-term objectives. Understanding how to invest in a bull market means recognizing that protection and participation are both part of the plan.

Ultimately, the right strategy comes down to the individual investor, their time horizon, goals, risk tolerance, and other unique factors.

This Week’s TakeawayLook at your portfolio. If markets fell 20% this next year, what would you do? If they rose 20%, how would you feel about missing out? Ultimately, what would be your action plan for either scenario if it happened? If there’s not a clear plan, then it may be time to revisit your strategy. Your personal investment strategy should balance conviction and caution, helping you stay confident through either outcome. You can’t totally eliminate risk, but you can decide which kinds you’re willing to live with. |

For Further Reading, Check Out:

A Middle Path When Markets Feel Expensive

What 15 Bear Markets Teach Us About Today’s Risks

The Art & Science of Investing: How to Invest and Get Rich the Right Way

Can You Still Make Money in Real Estate in 2025?